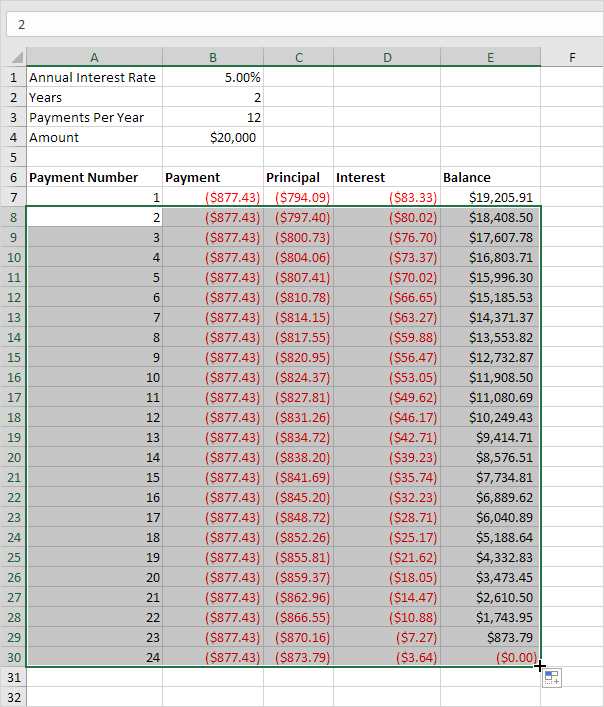

etc., so each row on the summary table, summarized one complete year (12 rows) from the detailed table).)īut is there a formula that would accomplish the same, without my needing to follow this two-step process? (i.e., on the summary table: column A would show beginning balance, columns B, C, and D would show sum of first 12 months from the "detailed table", and then column E would show ending balance. I can manually come up with the above by first creating a 360-row table ("detailed table"), and then creating a second 30-row table ("summary table") that uses data taken from the detailed table. I can easily use formula to create this table.īut what if I want to see this same information shown on an annualized basis - i.e., 30 rows of data instead of 360? (so that I can quickly evaluate what might happen if I made an extra principal payment, or to quickly see what balance would be at the end of year 10 etc.)

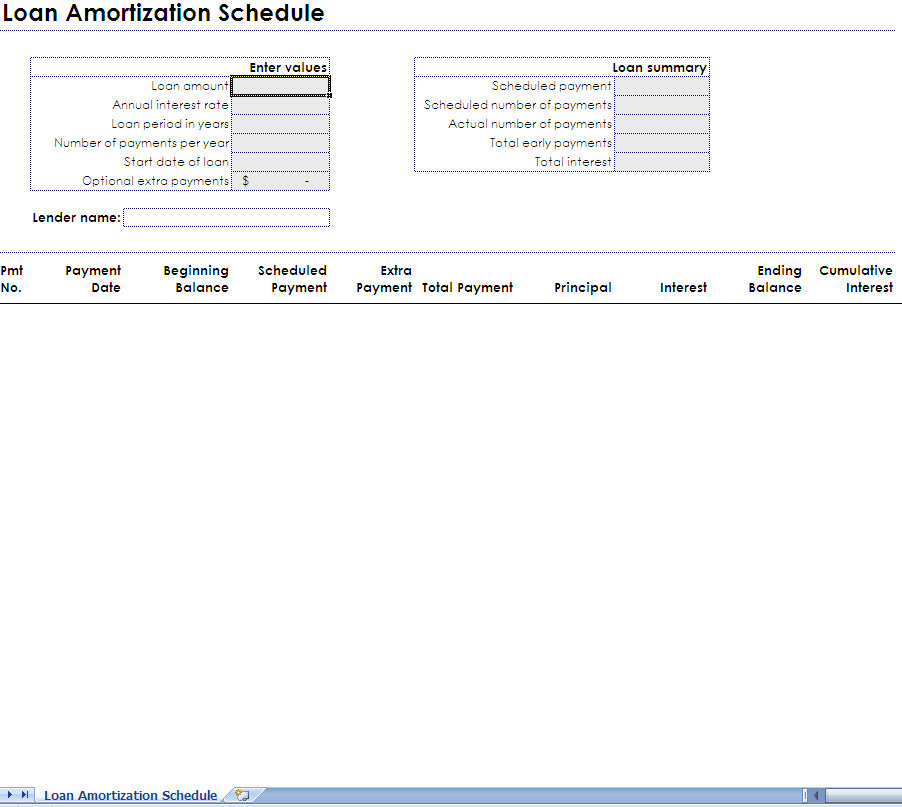

If this was a 30 year loan, there would be 30x12 = 360 rows in my amortization table. 1) Normally for a mortgage that is paid monthly, I could create an amortization table in excel that had columns set up something like this:Ī = beginning balance (= prior month ending balance, column E from row above)Į = ending balance (=beginning balance - principal = ending balance)

0 kommentar(er)

0 kommentar(er)